- Overall a bullish day roughy about 30 - 40 pips up from its open

- Risk was on

- Long term trend channel holding though there is a strong risk of failure at the 61.8 fib level

- Price can fall to 1.53 if this happens, we haven't seen such lows since the sovereign debt crisis The move that caused a 900 pip correction in one month

- BOE announcement tomorrow will either cause prices to shoot up off support or tank completely. No rate change is priced in though it will be key to hear the tone on inflation as that will most probably be the catalyst for tomorrows flow.

- It is most likely we will get Asian hour consolidation and then prices will claw up to 1.64

USDX

- Dollar index gapped down today and continued thorugh the day to be risk on

- Currently the DX can go in either directino up or down depending on the sentiment

- technically speaking a good down trend is in play, though it is possible a bottom is forming instead

- Short term support to 73.5 any breaks below can mean much lower DX and much higher majors vs the USD

VIX

- Vix falling with risk on, this seem sto be the trend. Risk off seems to be characterized with higher prints

ES

- Hit highs of 1292.75 however is struggling to stay above 1286 38.2% fib

- Tomorrows action needs to hit above 1300 to be bullish fails at 1300 can be pointing to risk coming off again.

EUR/USD

- Risk comming back on as markets calm down about the Greek Debt situation

- Imho none of this crap went away, markets will get distracted with risk coming on for awhile, but we will see the EUR/USD easily take another 500+ sometime in the future this year

- Tomorrow price action depends on the US FOMC meeting. Strong words of vigilence can cause the EUR/USD to tank or indication of hawkishness.

- Or its possible that the end of QE2 will lead to a giant USD rally as Kathy Lien suggest

- I'm biased towards weaker dollar

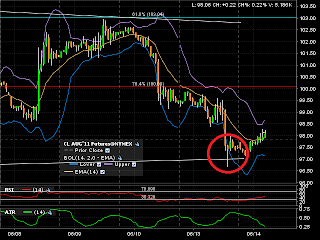

Crude Oil CL (WTI) AUG 2011

- Despite the dollar reaction lows crude remained under pressure

- price action is heavily biased to the downside.

- I look for buying on 90 lows on support

- or shorting on highs around 97.5 if prices fail

- Good chance prices will climb to 97.5 from current 93.6 lows