**skip to conclusion sections for consolidated stances/views - contact me if you feel commentary is much too "backwards trading" like and I will improve being more clear and concise on my stances and views for better accountability and performance assessments**

NZD/USD - So far my buy now rec from my last post has been right. However, I will have to take some fundamental considerations to the destruction of the economy because of the earthquake. I saw a few speculative headlines about the swap and interest rate markets pricing in cuts. This all depends on regional and domestic growth factors and the nature of the rebound. I am not well versed in the type of action the government takes in New Zealand, but if the fiscal action is lagging perhaps this monetary thesis may be true. For sure if the damage is "significant" there will be some dislocation between domestic and regional performance making room for some interesting pairs strategies or similar ideas. Look to NZD, AUD, SGD, or JPY products.

Short Targets if bearish sentiment true:

1. 0.728

2. 0.618

Such moves would take most of Q2 to play out if out right bearish.

I will have to say I am a bit more biased by the technicals and New Zealand trade ties. Strong demand from recovery of western/developed nations should give the NZD a boost in exports and help soften any economic damage the economy has suffered from the earthquake. Because of recent trade lagging, the pair has failed to enter new unexplored price territory like its counter part the AUD as of late last year. Of course a drag to this thesis is if AUD and NZD and regional interest rates continue to increase (quite a significant risk factor). This is a matter if one believes regional monetary authorities have the power to reign in high prices.

Aside from inflationary and interest rate risks, domestic demand and growth are still a strong driving force in the Asia Pacific region.

In other words, Ill stick to the technical thesis and hope domestic growth and strong trade to help float the NZD.

Significant bullish targets:

1. 0.78

2. 0.798/0.8 (big psychological level)

Conclusion:

Again, I reiterate to be clear - I still remain bullish on the pair despite sentiment and possible fundamental risk factors.

Side FX commentary:

- USD/CHF talk about slight risk relief on this pair. Like in my last post I said POST this pair would get a snap back once the risk averse affects mitigated. Perhaps that day is today unless London and European traders are covering long CHF positions. We will see if this is a fake out or not when New Yorkers open up.

- GBP/USD still trading in No Man's Land. Last night at 10:00 1.600 was taken out with tons of stops probably being triggered. causing the relief rally over Asain trading hours. Probably interbankers abusing client books to cause the move to the 00's. Im still bullish on this pair going out.

- EUR/USD still good on the upside.

- USD/JPY risk relief played out all yesterday

- AUD still stagnant perhaps due the it's interest theme

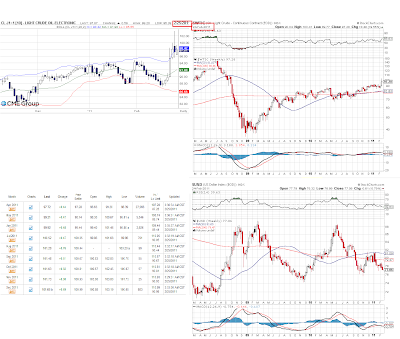

Crude:

April contract in context of rolling trend + back end contract expectations

- Dec 2010 Mild drop in dollar mild rise in crude

- January 2011 the trend we saw in most of 2010 (weak USD/Strong crude) broke down with big drop in the dollar followed by a corresponding drop in crude

- Going into February it seems the correlation came back strong with the first half of feb with strong dollar weak crude and then with the Oil crisis, weak dollar big spike in crude.

Looking at back end contracts we can see expectations are leaning towards higher crude. In the context of the rolling WTI contracts this would be inline with its long steady up trend from Jan 2009. Based off the technicals I'd say crude is in a great position to benefit for the first half of 2011. Though, there are rising interest rate risks to the correlation. However, I'd say it is more likely that interest rates may kick up in the latter half of 2011.

*side track*

Talking about interest rates feels so nostalgic considering how many years I've blogged in an environment with unconventional monetary policy and low interest rate regimes. When I had first started back in 2006/2007 interest rates plagued headlines and carry trade arguments were all over the place. The only interesting interest rate story that didn't get much lime light in the past few years were Australia and New Zealand themes. It seems the west countries were to preoccupied with crisis after crisis as fundamentals diverged (between east and west).

*back on track*

Anyway, if the oil crisis prolongs we may see the traditional correlation between crude and the dollar "outta-whack." Kathy Lien, director of currency research at GFT provides some insights

Here as to why we may see such a divergences, and explains further why

Here why eventually the traditional correlation will hold. I will agree with most of her arguments. However it is interesting how she spins her argument, by saying fundamentals are the driving force on crude which in turn affects the dollar, whereas I've traditionally seen it as currency drivers in turn affect crude. I will have to say in the short term the former may be more true, but eventually the latter will play out in the longer term.

Conclusion:

If the February correlation holds I see the dollar index falling to 75 which would mean higher oil going into march. Longer term out I will go with crowd expectations and say crude is still bullish.

SPX/VIX:

End of day SPX close yesterday saw a triumph for the bulls and a decrease in the VIX. Is this indicative of a the correction being over or is this just a hiccup in a bigger downtrend. To be consistent, I expect the spx to consolidate and drop further to its 50 day SMA. Short term bear still.