I came across a great piece of technical analysis this morning while reading kevinsmarketblog.blogspot.com:

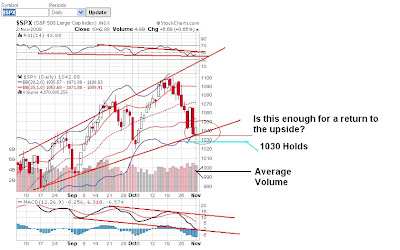

"An interesting pattern has been developing over the past few months in the stock market which I'd like to share with you. You'll notice in the above chart of the S&P that there has been a tendency for stocks to sell off towards the end of the month and then rally at the beginning of the month.

What I find interesting is that each of the sell offs have been gaining downside momentum. In other words, each down move has been larger than the previous month's down move. Having said that, if the pattern continues to work, stocks could be in for a very negative week as we close out the month. As always, there are no sure things in the market so lets just see what happens."

Thoughts:

This morning we will see earnings from Tiffany, revised GDP numbers, FOMC minutes, FDIC earnings, Home Price Index, and consumer confidence. This day could be the straw that breaks the camel's back. I have been waiting for the pullback since the ides of the month. Currently I am short a financial stocks through a prominent long financial ETF.

Be aware of the volume. Herd trading could leave you in or out of the money going into the Holiday break.