Who does America love to throw money at? (All charts created at the www.bea.gov)

US Investment to Foreign Countries (FDI - Foreign Direct Investment):

I generally look at the world regions. Then focus on the regions where the most US FDI has been. Then pick out countries that seem to be favorites where US FDI has been higher than relative peers. I do this mostly by looking at the graph to save time, but you can double check US Foreign Investment Abroad data tables at the www.bea.gov for accuracy if you desire. I believe the general trends already can tell us a lot about US FDI.

Lets look at all major regions:

My initial expectations were that Asia Pacific would be on top in terms of FDI flows to other countries. I was surprised that:

- Europe was way above any other region

- Asia was actually not the highest area where FDI flowed to (well thats given via. number 1)

- Latin America and other Western Hemisphere was above Asia Pacific.

Intuitively I would have expected that Latin America would make up most of the bulk of FDI flows for the region. I thought a high concentration of the Spanish speaking population in the US would help foster investment to the Latin America region.

To see what was going I chart US FDI flows by country for the Latin American and Other Western Hemisphere Region (Central America, South America, other Latin America and Other Western Hemisphere (Caribbean islands etc..):

Surprisingly my expectations were wrong again as Central and South America did not get the bulk of the FDI, but instead Other Western Hemispheres did.

I then double check on an individual country basis.

The top two green and whitest lines are the regional trends. Right below that is Bermuda, and the bright blue trend with the positive slow was the UK Islands, Caribbean. I only examine the top two countries as a revelation hits me. I graph them below:

The two big FDI trends in the "Latin America and Other Western Hemisphere region" (LAOWH) was due to large inflows to the Caribbean Islands and not because America was investing in Latin America.

After some thinking it hit me these trends probably explains the huge boom for offshore Hedge Funds going into the 2000's. Bermuda has been the top place for Fund domicile for the longest time. Going into 2000's the Caymans increase regulation and captured market shares by having lower cost for market entry. This would explain the Uptrend for the UK Caribbean and why Bermuda is still far above the UK Caribbean (Bermuda was Favorited for a long time period than the Caymans). Bermuda of course was severely hit with redemptions post 2008 crisis hence the sagging trend.

The reason why I plot Chile up there was because it seemed to be the only other country in the whole region that enjoyed a continue positive FDI inflow trend from the US besides the UK Caribbean. Possibly a country to be bullish on?

Since I established the LAOWH region is possibly an anomaly due to the alternative investment industry, I focused on real FDI flows that would could translate into actual growth for regions i.e. Europe and Asia.

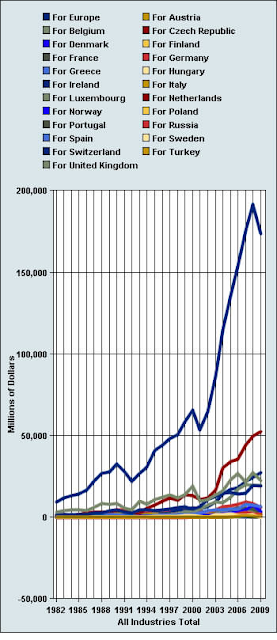

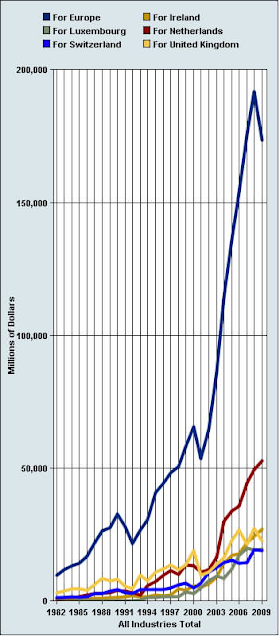

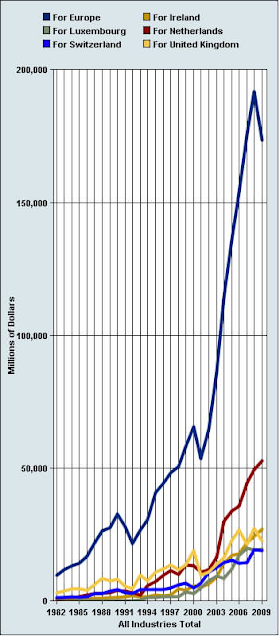

Europe - so which countries do Americans want to invest in. I plot all the countries in Europe

The top blue curve of course is for all of Europe. For those who are not familiar with the European region might also be surprised to find the Netherlands the top destination for US FDI in Europe. While it seems Switzerland, Luxembourg, United Kingdom and Ireland are favored destinations for FDI in Europe. Below are the ploted countires.

I was surprised that Netherlands was a top destination for FDI flows in Europe. In fact this is the main reason why Europe was the top region for FDI flows. Of course just like Caribbean island, it becomes obvious why this is the case after a little research. I remember reading in the economist a few weeks back about Frankfurt exchange/NYSE merger and how they planned to be headquartered in the the Netherlands. I figured that this was due to tax reason as otherwise there would be no reason to headquarter there. After a bit of research the Netherlands is indeed somewhat of a tax haven for those seeking European exposure. Though EU integration mitigated the Netherlands's tax haven effect, fast tax reform has maintained its competitiveness. I believe it still remains a top choice as a gate way to European Markets for investment.

The other trends for the UK, Ireland, Switzerland and Luxembourg can also easily explained:

UK - The UK is traditionally and still is a leading financial center in the world. It has maintained its dominance as a country for US FDI before the 2008 crisis, though took a huge hit in investment flows after 2008, which is when Ireland took the lead.

Ireland - The amazing boom to bust story; however only the boom part is on this chart above. A developing technology center and favorable taxation had made Ireland a hot spot for growth, and as seen above, ideal for investment as well through 2009.

Switzerland/Luxembourg - Switzerland has always been a favorite country for HNW individuals who had nothing better to do than stuff swiss private bankers with their "tax evasive" funds. I assume due to the high concentration of wealthy people and close proximity to Switzerland, Luxembourg naturally benefited for the same reasons and enjoyed more FDI flows towards the end of the decade.

The most interesting thing about this data is that it only goes up to 2009. Hence we miss out all the FDI changes due to the European Sovereign Debt Crisis. Perhaps the Netherlands will remain some what resilient, though I would expect that Switzerland/Luxembourg, and Ireland US FDI flows to suffer the greatest.

With the US government raiding swiss banks and demanding greater transparency, I'm sure investments are flying away to other regions. With Ireland's great boom came its great bust with its whole banking system and sovereign debt.

However the story may be different with the UK. If the UK's austerity has instilled confidence, perhaps FDI flows to the UK will be around the same levels (its currency has certainly been robust in the 1.60 range the past few weeks).

Moving on to Asia

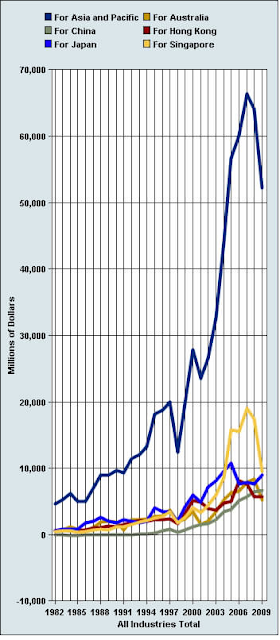

Of all the countries in Asia where has US FDI been the Favorited?

I separate 5 countries where there is the clear FDI flow gap. The top 5 countries that enjoyed the highest US FDI flows through 2009 were Singapore, Australia, Japan, China, and Hong Kong.

Singapore - Singapore US FDI flows appear to be quite speculative as US investment were growing exponentially from the early 2000's and then stopped after the 2008 financial crisis. Singapore probably received lots of US for a number of reasons:

- PAP's firm control which provided favorable business environment

- Strong English speaking skilled work force

- Favorable taxes

- A good alternative to Mainland China + South East Asia

- Strong benefits to bull markets and trade flows (trade and supply chain)

- strong development as a financial center in the early 2000's

Japan - Japan early 2000 US FDI growth was quite strong as US investors must have been investing on better Japanese economic growth prospects. These FDI flows clearly fell apart way before the 2008 crisis due to failed expectations.Interestingly though, US investments picked strongly post 2008 crisis through 2009 as risk appetites increased.

Hong Kong - Arguably Hong Kong benefited for similar reasons that Singapore benefited from. The main difference is that Hong Kong's markets have been saturated far longer and probably presented less investment opportunities (also less room for speculation).

Australia - Australia benefited with overall strong growth due to high commodities and strong Asian demand. I my best guess is that US FDI into Australia would be a good option if one wanted Asia Pacific growth exposure in an English speaking country.

Other US investments could have favored Australia for its high interest rates or for carry trade purposes. It was clear though that any of those affects probably were limited as interest rates had to peak out at some point. Whether or not this is the reason, we see US FDI strong dropping after 2006.

China - Ever since China joined the WTO in 2001 and opened its doors to investors it has seen very strong steady grow and US FDI inflows.

By the end of 2009 Singapore and Japan's US FDI flows were about the same. However Singapore's peak of US FDI flows was significantly higher than its peers possibly indicating the speculative nature to foreign investment before 2008. The 2008 crisis hit export oriented countries such as Japan, Singapore, and Hong Kong very hard, which is probably why those countries saw a strong decline in US FDI during the following years.

As economies around the world normalize we will probably see more healthy balanced FDI flows into Singapore, China and Hong Kong. It is possible the end of 2011 will present foreign investment opportunities in Japan as recovery from the Sendai earthquake crisis begins. Though, it is more likely domestic growth and continued repatriation of the Yen will out weigh any US FDI flows.

Currently Australia's growth is questionable in the short term, however as long as the rest of the region grows, there will be plenty of US FDI opportunities in Australia.

Conclusion:

Though a lot of these conclusions maybe intuitively obvious I will state them anyway.

2010 FDI flows will probably be greatly mitigated in the EU region as the sovereign debt crisis continues to drag on along with EU integration issues. It is possible, however, that the Netherlands will probably remain resilient as it is still the best choice for any exposure to European markets.

This being said, it is given that any country who has favorable tax regimes, stable politics, strong regulation, and a business friendly environment will be key places for US FDI.

Asian markets will continue to grow and will continue to present foreign investment opportunities for the US. There is a strong possibility that 2010 FDI flows to the Asia Pacific region were greater than to the European region as the financial crisis effects wore off. If that is the case US FDI flows between the European region and Asia region should have narrowed in 2010.

All of the FDI flows of course will be facilitated as long as US domestic growth is ensured and risk appetites and pent up cash are unleashed with growing opportunities abroad.

From the data above, we saw that European Markets were favored for FDI flows from 1982 through 2009. Though the data hints this trend is poised to change due to current events. The Asia pacific region was the next favored region for US FDI flows, excluding LAOWH region (for cited reasons above). In Asia it is likely that China's steady growth will continue to attract US FDI and may catch up to Singapore, and Japan US investments levels.

Alexander Lê

Managing Partner

Analyze Capital LLC

analyzecapital.gmail.com