http://www.cmegroup.com/education/featured-reports/inflation-commodity-prices-and-portfolio-diversification.html

http://www.cmegroup.com/education/files/PM132_Education_portfolio_diversification.pdf

Here is an interesting two page article via the CME.

The CME trys to demonstrate using commodities as diversification tool via futures curve can be an effective way to diversify one's portfolio.

- They point out academics claim inverse correlation between stock markets and inflation

- They elaborate further that this is not always the case

- Demand pull inflation has positive correlations with stock markets in either recessions or bullish economies. Therefore commodities = bad diversification tool in such periods.

- On the other hand Supply Shocks will result in inverse correlations = good diversification tool in such periods (Neg supply shock --> higher commos prices --> negative stock prices via cost push inflation and vice versa)

- Of course the latter point is what they want to stress since negatively correlated assets are ideal for MPT (modern portfolio theory) practitioners for "diversification".

- So of course then, as they point out, it is key for the portfolio manager to be able to distinguish between demand pull and cost push inflation.

- They way the CME suggest to do this is by looking at the futures curve, a.k.a backwardization and contango.

- The CME believes that a contango curve will lead to demand pull inflation and backwardization will lead to cost push inflation.

I believe the CME of course is trying to conclude that if you are seeing rising inflation and can identify it as cost push inflation via some type of backwardization curve, commodities can make a great diversification asset class. They give a Class III Milk futures example of the year 2003 as a backwardization period and the 2008 crisis as a contango period. **This is a bit off point but the Class III front month from mid 2010 has been one heck of a wild ride! I think its one of the most amusing charts to look at in the past few months.

I would like to point out from the above:

- Even though the CME is able to get closer to a better diversification idea with futures than academics has, the picture is still even further more complicated than supposed

- The importance for dynamic portfolio re-balancing and qualitative measures in MPT practice

- A way to deal with inflation given the current environment (2011 and forward)

1.) Though the CME certainly does have a point, the past year and months have not necessarily behaved in the way the CME has suggested due to the unique nature of the recession markets have come out of. In addition, over longer time frames the CME maybe correct, but when a portfolio manager is faced with high interim volatility like we saw in march 2011, a manager may re-balance a portfolio inefficiently due to the disconnect of what the CME theory suggest and what actually happens or what is portrayed in the media.

For example this past March I saw brent crude oil spike to 116 - 117; expectations were all about a negative supply shock due to MENA risks. However, brent stayed in contango for most of the month. Had a manager re-balanced according to expectation all diversification effects would have been lost.

Technically this negative supply shock should lead to cost push inflation and push the curve into backwardization. Either the OPEC increase of production worked REALLY well and fast, or there is a lagged effect of the higher prices ( and we have yet to see backwadization which will lead to a lower stock market).

Furthermore, even though the past year firms have seen rising costs, many of the firms are lush with cash and are able to swallow the cost increase without passing it on to the consumer. There have been quite a few negative supply shocks (e.g. corn markets and wheat markets) in the past year. However its very possible, with ample cash, firms are willing to take a short term loss, so that a backwardization curve may not filter through to cost push inflation and thus negate any negative correlations or diversification effects (commodity prices up and stocks down).

My two examples above of course outline

- qualitative risk where a manager re-balances according to wrong expectations

- and possibly reading a futures curve that would lead to a sub-optimal portfolio due to unique economic and financial environments

This of course leads me to my second point;

2.) Perhaps the reason why David Swenson was so successful was in that he was able to understand context and thus appropriately apply the correct qualitative measures to his portfolio re-balancing. The easy part perhaps are the quantitative measures; determine allocations for efficient portfolios, determining institutional investor utility, figuring appropriate risk levels. Perhaps the hard part is being able to effectively incorporate qualitative measure when re-balancing portfolios so that institutional targets and goals are not missed.

In this respect, this is where discretionary managers and traders can truly add value, and where purely investment oriented algorithmic processes lack value. Using inappropriate static models in the wrong context is sure to lead to disasters or undesired results. Traders and discretionary managers are constantly working with thesis, and models, and adjust views according to context to achieve desired results. Of course such methods are borderline art and will turn off purely quantitative mindsets. To which I would respond, watch

Andrew's Lo presentation on "physics envy" which explains why such thinking is a fallacy. Both qualitative and qualitative processes are very necessary to achieve much more efficient results.

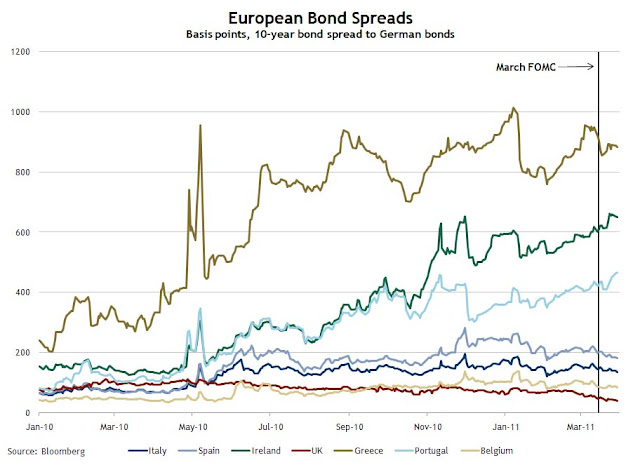

3.) Currently the Fed expects inflation to be capped at 2% to the end of 2012. In half an hour today, we will hear Bernake speak, and he will most likely speak about the current oil spike as causing transitory effects. A one off effect, which in the long run has close to no lasting effects. Just like how Greece and Ireland default effects were small spikes in a overall strong downtrend of High Yield to Corporate credit spreads over the past 3 years. (I believe those inflation estimates are for headline inflation as well, in other words core CPI growth probably even less).

That being said, an manager should ensure superior returns vs the rate of inflation. Ideally a manager's returns that far exceeds 2% annually for the next few years probably won't have to worry about inflation. If a manager is struggling with being able to return 2% annually perhaps it is time to decrease your assets if your AUM growth has been inversely correlated to your returns(or spin off some other fund), work on new scalable models if returns have been stagnant at current AUM, or perhaps inject new human capital into your firm. Worse case scenario you can do what Man Group did and acquire a better firm with a better track record.

Of course having returns higher than 2% is ideal for Analyze Capital as portfolio management is trading oriented. Positions usually will not exceed more than a few months and have positions within daily time frames and are purposely concentrated. Analyze Capital does not practice traditional portfolio management, but however does use some of it's concepts. Managers who are stuck with long term core positions such as traditional portfolio managers that practice MPT or funds that require longer time frames may have to worry about the effects of inflation over the long run.

Overall though, I would say the risk of inflation is going forward is low if anything. Focusing on alpha generation should be enough to negate any effects of inflation. Of course if the exact opposite happens and we get hyper-inflation, putting money into an asset class like gold would be beneficial. The flight to quality would certainly make gold an interesting asset to follow again, and allocate to, in the case of hyper inflation(lately it has been very boring imho).

PS. of course the CME doesn't care what you use for whatever purpose as long as you use "their" products

Analyze Capital LLC

AnalyzeCapital(at)gmail.com