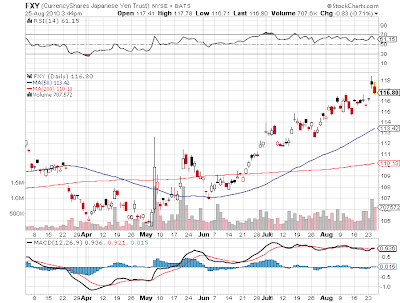

-I expect to see a retest of 83.75 levels, possibly as low as 83.25

-The BOJ cannot solely rely on tough talk to weaken the Yen, they must show & prove intervention to the market

-Momentum and Volatility remain flat; no reason to get long or short until a catalyst appears

-The 20 day SMA will serve as short-term resistance; 85.75-86.25

-RSI resistance at 55 levels remains firm

-Don't discount strong economic data; Unemployment sits at 5.3% and a Current Account Surplus is 3.3% of GDP.

Trade: I will get long once I see a retest of 83.75 lows. The BOJ will intervene through Quantitative Easing policies in order to allow the exchange rate to bounce to the upside. Once long, I'm looking for 800-1000 pips to the upside.

------------

VIX 6 month Daily

-200 Day SMA has held as a floor since the 'Flash Crash'

-The 20 day SMA is about to cross the 50 day

-RSI is poised to break through 60 and test 70 overbought levels last seen in May

-Momentum has plenty of room up to 2.5

-As long as money continues to flow out of Equities into Bonds, volatility will persist

-----------

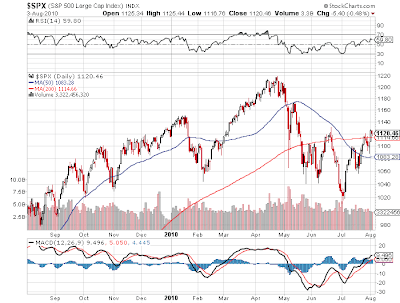

SPX 6 month Daily

-A head and shoulders reversal pattern is well underway

-RSI failed at 50 and will go low until it tests oversold territory at 30

-Momentum topped out and has plenty of room to the downside

-The 20 day SMA will converge with the 50 day SMA in the next couple of trading sessions

-The above chart supplements the VIX story

-This week Consumer Sentiment, China PMI, Euro Zone PMI, U.S. ISM, and NFP take the market sentiment spotlight

Trade: Short SPX till 1000. Look for short-covering/a relief rally before entry. ES Mini Futures are a great place to start. Also, the ProShares UltraShort S&P500 ETF SDS is another way to double down on your bets.

-----------

Related ETFs: ProShares UltraShort S&P500 (SDS), CurrencyShares Japanese Yen Trust (FXY), iShares MSCI Japan Index (EWJ), Consumer Discret Select Sector SPDR (XLY)

Patrick M. Ambrus

Analyze Capital LLC

Twitter: AnalyzeCapital

.png)

.png)