**Skip to Summary for quick conclusion:

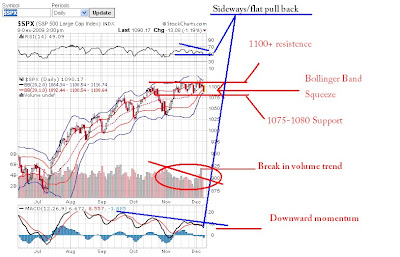

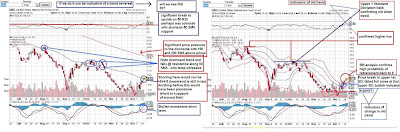

The Daily Chart (short term thoughts)Chart 1:

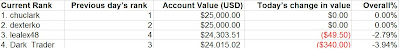

Its been awhile, but I'll try and keep it brief. Some new develops I found interesting enough to write about with what little time I have with finals approaching:

TRADER MIKE <-- click here Somewhere in one of Trader Mike's blogs he refers and as I paraphrase "to the SPX pulling back in a side ways fashion" ... If you do look at the support and resistance levels I drew out the SPX has been trading in a range. Evidence as a pullback despite static prices lies in falling RSI and downward momentum as seen in the MACD.

RSI:

Interestingly enough the RSI is still holding at 50 support. However, as we see from the beginning of November, the RSI does not manage to reach 70+ and fails around 60+ instead. This could possibly indicating a weakening of trend.

IF 50 RSI breaks to the downside momentum can fall further.

MACD:

A weakening of trend can be confirmed by looking at the MACD's reversion to center-line balance at zero. (seen in Chart 1)

Volume:

Volume's downtrend can be indicative of a weakening trend as well. With the holiday season approaching, volume will be lighter and much uncertainty has yet to be priced in fully about holiday performance (esp. in the consumer sectors of the SPX).

Though interestingly enough we see an abnormal spike around the day of the Employment announcement Dec. 4th. This abnormal spike (above the average volume)could show that that there are many bulls still around defending the 1100 line.

Prices:

All these indicators pointing to downward movements only have resulted in the SPX trading in a range. Bulls and bears are almost evenly matched reflecting the uncertainty in the markets. All this has led to a price squeeze for almost two weeks now, which will result in a big pop. The big question is if it is the upside or to the downside?

To figure this out I look to the

long term charts:

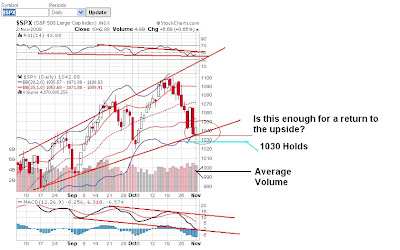

Chart 2:

Looking at the SMA evidence as shown above (chart 2). There is significant support for the short term seen in the Daily chart AND the weekly chart. Back in Nov prices flirted with the 50 SMA but have managed to stay above that level for over two weeks. This is reflected in the monthly chart as having Mid term support on the 100 SMA. These two support factors should give enough strength for prices to break through 1100 resistance within

2-4 weeks establishing a new uptrend.

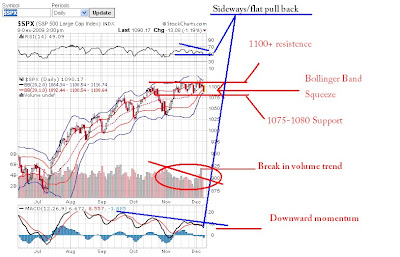

Chart 3:

The chart above (chart 3) shows that, considering price alone, that if resistance is broken at 1100 there is room up to the high 1200's.

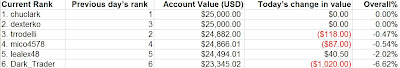

Chart 4:

Chart 4 shows that MACD although in the short term has been trending down as seen in Chart 1, the MACD shows a that markets might have possibly stabilized as "current post-recession (2008 issues)" MACD levels are similar to "pre-crises levels (before 2007)." The left side demonstrates that the possibility of a 1100 break in resistance existence with room for upward momentum to 20 (historical highs on MACD - pattern analysis points up). The tightening of the range IMHO is a good sign for bulls. **I stress however that this bullish move is on in a short term time frame of about 1 month+ or so (where prices would be between 1100 and 1300).

I would also site the RSI shown in Chart 3 as having room to 70 "IF" a trend change is not taking place.

HOWEVERLong term I would have to make a more bearish call which would coincide with strong resistance levels of around high 1200's along with 200SMA price resistance shown in Chart 2. This time frame would put me into mid second quarter or into 3rd quarter 2010.

Summary:

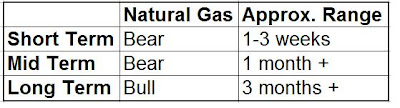

Short Term: 2 weeks - 1 month: I expect a break in 1100 resistance to the upside.

Mid Term: Into First Quarter 2010

Long Term: Bearish into Second/Third Quarter 2010:

--------------------

** I would like to note that MACD and RSI in short and long frames do point to room to the upside but are already in high level territory which means greater downside risk. Calling a break in resistance of 1100 is very risky considering the picture seems very toppy at the moment. However, I still stand behind my thesis and assess my performance moving forwards.

**Disclaimer: this only involves look at technicals on the SPX and does not include other market influences such as Currency, Bond, Macro, Commodities, Central Banking Analysis.

Alexander Lê

Analyze Capital

Managing Parnter

Email: le.alex48@gmail.com

"Well, ladies and gentlemen we're not here to indulge in fantasy but in political and economic reality. America, America has become a second-rate power. Its trade deficit and its fiscal deficit are at nightmare proportions."

"Well, ladies and gentlemen we're not here to indulge in fantasy but in political and economic reality. America, America has become a second-rate power. Its trade deficit and its fiscal deficit are at nightmare proportions.".gif)