A hell of a day . . .

Compliance, Regulations, and Law are making my head spin. Good news is AC Federal taxes were accepted. Hopefully no red flags from the IRS. Since tax accountant services can cost a small man a fortunate I had to do the self route. Luckily 2010 trades were not complex.

Next business in order, Delaware LP incorporation; Quite a bit complex and costly for a start-up vehicle, but I can manage. I was doing some "rough" calculations, and I estimated that a fund would need USD 1M to USD 1.5M in order for a 8-12 month track record to be taken seriously. This is assuming no performance considerations. Perhaps you are thinking, "no performance considerations? ... but that is all you need to consider!" Well unfortunately even a start-up fund with a perfect track record won't be able to get a well-balanced diverse stable client portfolio without the necessary infrastructure (a balance between institutional, High Networths, and HFs/HFoF/Seeders). The considerations assumes a 1% to 1.5% management fee, depending on the AUM, which would be barely sufficient enough to pay off annual infrastructural cost. This also assumes a fund with USD1M to 1.5M would be using boutique Administrators, Auditors, and Legal Advisors only. Of course if we now throw in performance considerations the fund would have have to at least return 1% - 1.5% annually to break even. Naturally, breaking even definitely wouldn't hold for a whole year for investors...

Due to investor due diligence awareness, institutional bias as HF clients (though this trend is reversing to an extent), obsessions of ill defined risk characteristics, the financial crisis causing huge regulation changes, our good friend Mr. Maddoff and Co. (all other schemers)... causing even more regulation scrutiny... the HF world is not longer a economically feasible endeavor for the average Joe (oh yea lets not even mention Dodd Frank and I won't even get into EU regulations...)

Once again I am stuck to paving the odd way through... by in large, I will be able to fly under the radar through exemptions due to my teeny tiny size for now. When, or shall I say "if" AUM does grow, I will build the proper infrastructure accordingly. I already have some mechanisms in mind to help facilitate a make-shift Administration process that is transparent and relatively unbiased. Which will hopefully legitimize any audited track record post LP Fund creation/launch.

I will comment that the boom of the hedge fund industry surely has been accompanied by the boom of institutionalized tool makers of the trade (Administrators, brokers, market makers, auditors, consultants, and lawyers). Looks like I'm trying to dig for gold in this rush, while everyone is shoving levis' and pick axes down my throat without an alternative option.

-----------

SELECTED MARKET COMMENTS

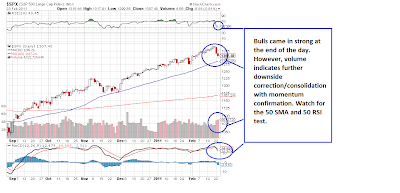

6 month SPX - Bearish Considerations

As I mentioned in my last POST the SPX was indeed due for a correction. I expect a few more %'s to get knocked off.

For bulls trying to buy in on a pull back I would be careful with volume considerations. The yearly chart shows an extended SPX in a very healthy up trend (August 2010 to Feb 2011). My qualm is that it is "too" clean/healthy. The daily ranges are suppressed with a very long period of low volume. A vix comparison (though not the best indicator of volatility) + BB analysis shows less volatility on thinning price ranges. Subtle bearish indications to me.

Conclusion:

WITHOUT fundamental considerations I am biased short on the SPX to the end of march mainly on technicals.

Brief on FX:

- Pound still holding its ground - my skew is bullish on GBP/USD (mainly fundamental and technical reasons - time frame on a week to week basis)

- USD/JPY is getting benefits from risk averse flows - again very similar to early 2010 thesis on Japan. Getting positive sentiment for the country.... I still can't figure out why its skewed this way.

- USD/CHF - CHF benefiting from risk averse flows as well, but will unwind once negative sentiment reverse in the UK and EUR region (i see it sooner than later)

- AUD/USD - I believe due to structural/geographic/fundamental reasons will comfortable trade above parity form now on - possible down ranges to 0.95 range worse case scenario (poor growth prospects in asia) and ill weigh a heavier probability to 0.98 on downside action. Though, I reiterate, I believe it should trade above a parity hear on out.

- NZD/USD - Fundamentally in awesome position to rebound once this short term sentiment earth quake trade wears off. Buy now.

17:41 EST Wednesday 2011

Conclusion:

It would seem I am more skewed toward dollar bear going into Q2 2011. Ill have to take fundamental and sentiment considerations before making a full out thesis on Forex however.

Again, no recaps on 2010 yet, ill try to get them in when I can. Good luck trading to all.

-------

Alexander Lê

Managing Partner

Analyze Capital LLC

analyzecapital@gmail.com

No comments:

Post a Comment