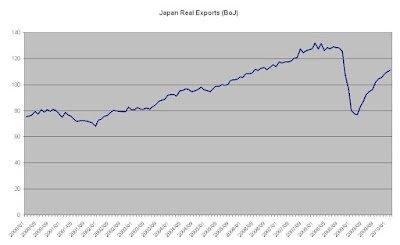

Check out that HUGE recovery in Q1 exports compared to 2009

Japan's current account surplus widens 65% in March

They may have answered part of the reason why Japan has been seemingly uncorrelated to other major pairs. As I said in the comment of my previous post the technicals show on a year by year time frame the Yen actually is in an uptrend. Aside from 2010, for most of the first quarter which the Yen has pulled back (a re-alignment of the pair with other major pairs), it is still poised to rally.

Part of the reason possibly is that Japan has been able to export away the recession going into 2010, kind of how the US did in 2009 with the weaker dollar. Now that things are turning around (along with other relative economic weakness around the world), the USD is now in full uptrend mode.

The current account surplus of Japan as the article hints (I'd have to double check the gov't stats for accuracy), says that it is mainly due to higher exports.

On the fiscal side, Japan may seem to be in a better position across the developed countries. However, I won't mention the terrible political scene and other economic problems Japan has, but capital certainly has been flowing into the Japanese economy...

Only if work were as exciting as studying for finals, my first two finals tomorrow! 1/2 way done with what is needed for me to leave Uni!

----

Alexander Lê

Managing Partner

Analyze Capital LLC

email: analyzecapital@gmail.com

Very true. This time is obviously Yen weakened. JPY dropped against major currencies including USD, EUR, CHF, NZD, AUD, and CAD. Good thing for Japan, as a country has favorable balance of trade.

ReplyDelete